Our recommended tax agent provide comprehensive support for your financial and tax filing. We ensure timely communication, proactive deadline management, and a streamlined process. Focus on your core business activities while our professional partners handle your tax needs.

We ensure your compliance throughout your business journey

Seamless Company Taxation Service Malaysia with Our Expert Partners

We are a licensed tax firm approved by Ministry of Finance under the Income Tax Act 1967 and Good and Service Tax Act 2014 based in Klang Valley.

Our Tax services division formulates effective strategies to:

- Effectively maintain tax compliance with relevant laws

- Implement innovative tax planning methods

- Optimise tax incentives to reduce tax liability

Regulatory compliance is amongst our core competencies. We offer professional and technical advice in all aspects of Malaysian tax laws.

This is especially critical due to the new Self Assessment Regimen implemented by the Malaysian Tax Authorities (MTA) that requires businesses / individuals to voluntarily assess their income and make payments on taxes due on a timely basis. Accounting records would also have to be kept updated, as the MTA would randomly be performing “tax audits” from time to time.

Type of tax filling:

Company Taxation Service Malaysia

1. CORPORATE TAX COMPLIANCE SERVICE

- To prepare and file at the Inland Revenue Board (IRB), the Company’s annual tax return (Form C) and, in that connection, prepare the income tax computation.

- To advise the payment of the balance of tax (if any) based on the Company’s annual tax return.

- To advise the due date for submission of the return of original estimated tax payable (Form CP 204) and compliance requirements in relation to the amount of the estimated tax.

- To complete and submit the Form CP 204 based on the amount of estimated tax payable furnished by the company.

- To remind for the 6th and 9th month’s revision of estimates of tax payable.

- To prepare and submit the revision of estimate of tax payable via Form CP204A, if any.

- To remit monthly tax instalments payment at the IRB payment counter (excluding cheque collection services from your office).

- To send the tax instalment scheme or CP 204 to the company and to confirm receipt of the same.

2. TAX PLANNING & ADVISORY SERVICE

- Company Tax Planning

- Re-structuring

- Group relief

- Group credit set-off

- Application of tax incentives

- Pioneer status

- Investment tax allowance

- Reinvestment allowance

- Company allowance

- Industrial building allowance

- Export allowance

- Double deduction

- Retirement scheme

- Pre-tax audit

- Withholding tax planning & advisory

- Real Property Gain Tax (RPGT)

3. CLUBS, ASSOCIATIONS, MANAGEMENT CORPORATION OR SIMILAR INSTITUTIONS

- To prepare and file at the Inland Revenue Board (IRB), the association’s annual tax return (Form TF) and, in that connection, prepare the income tax computation.

- To advise the payment of the balance of tax (if any) based on the association’s annual tax return.

- To advise the due date for submission of the return of original estimated tax payable (Form CP 500) and compliance requirements in relation to the amount of the estimated tax.

- To remind for the revision of estimates of tax payable.

- To prepare and submit the revision of estimate of tax payable via Form CP502, if any.

- To send the tax instalment scheme or CP 500 to the company and to confirm receipt of the same.

4. PERSONAL TAX

- Form B (Personal tax with business income)

- Form BE (Personal tax with employment income)

- Form P (Partnership)

- Form M (Personal tax for non-resident)

- Form PT (Limited Liability Partnership)

5. SALES AND SERVICE TAX (SST)

- SST Registration

- SST Consultation

- Preparation and review of SST Form

- Bi Monthly Submission

6. OTHER TAX SERVICES

- Form EA

- Form E

- Tax Clearance

- Tax Credit Refund

- Tax Credit Set-off

TAX AUDIT & INVESTIGATION

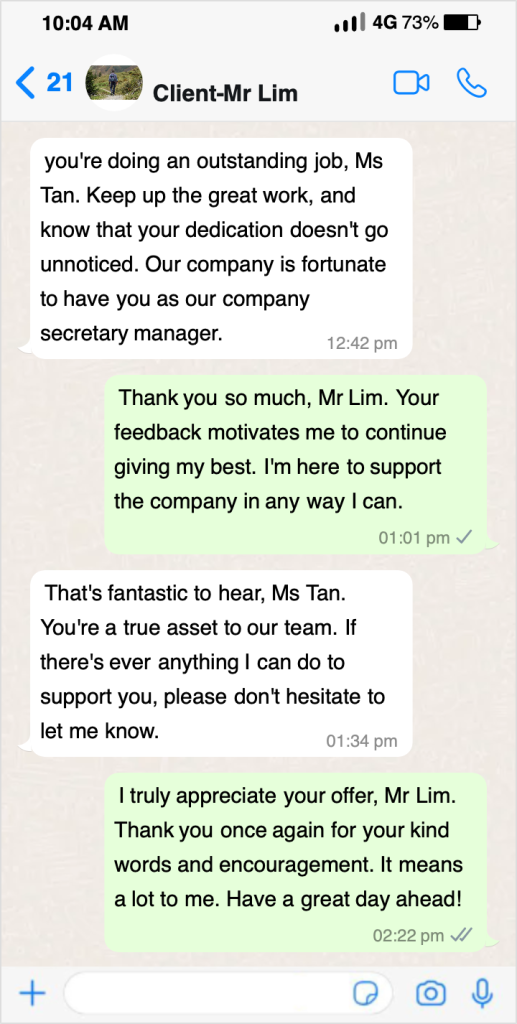

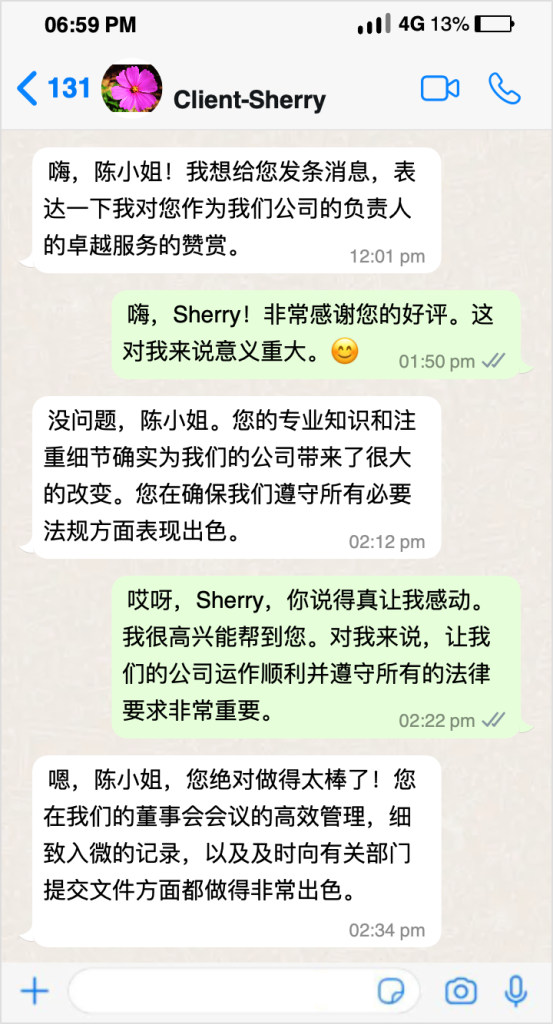

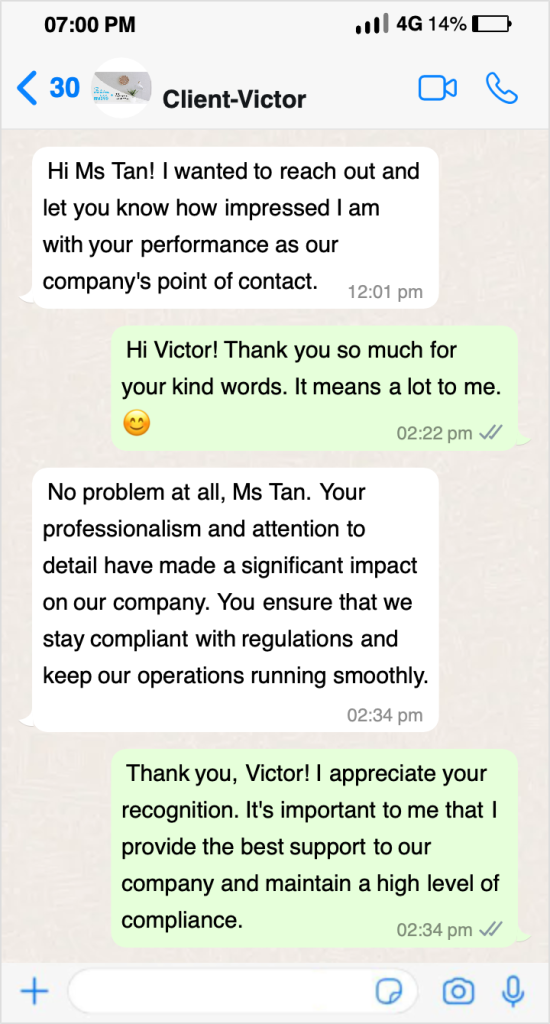

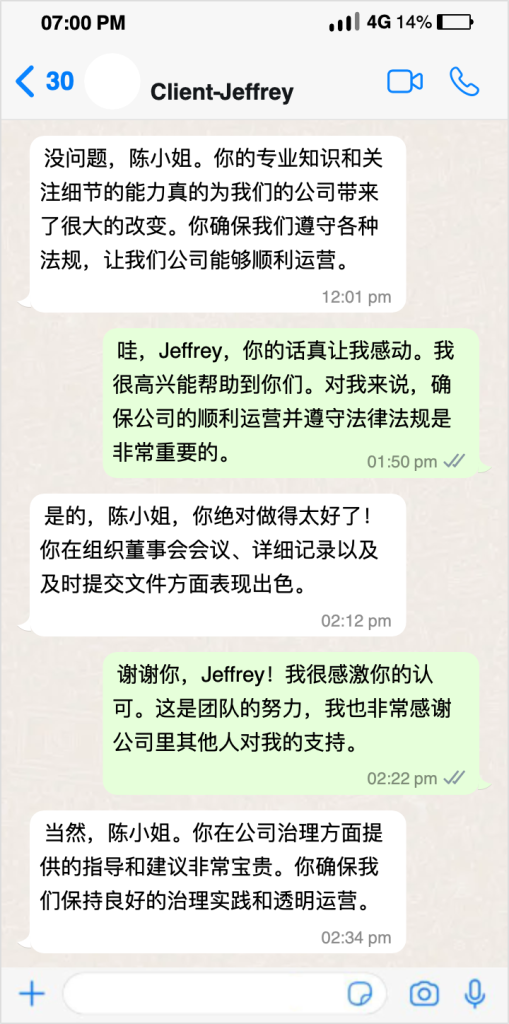

What Our Customers Say About CGL Services

Your words will motivate us to improve ourselves to serve you better.

Optimize Your Financial Compliance with Our Professional Tax Services

Our experienced auditors will meticulously examine your financial statements, internal controls, and compliance with regulations. Contact us today to achieve greater transparency and reliability in your organization’s financial operations.